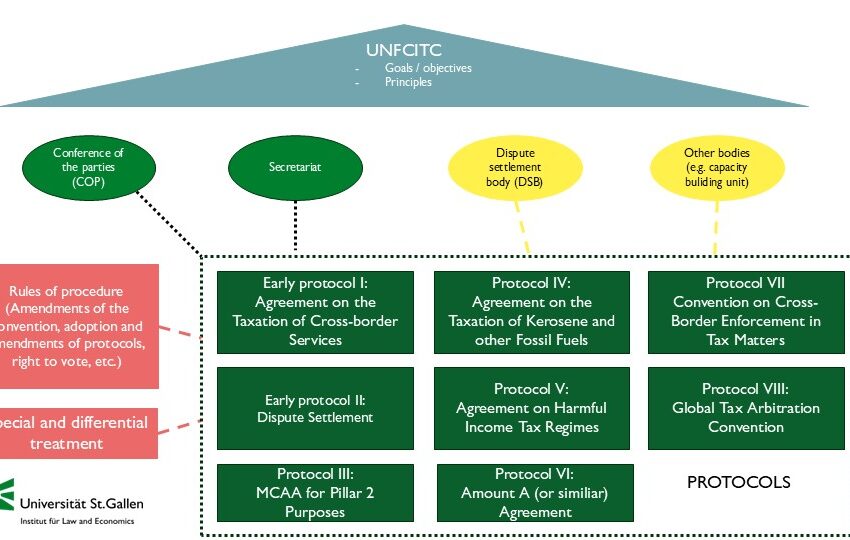

By Peter Hongler and Irma Mosquera The latest draft of the UN Framework Convention on International Tax Cooperation (UNFCITC) introduces several pivotal

Continue reading

The UNFCITC and the Future of Mutual Administrative Assistance

By Peter Hongler and Irma Mosquera The latest draft of the UN Framework Convention on International Tax Cooperation (UNFCITC) introduces several pivotal provisions relating to administrative assistance. In particular, the text addresses Illicit Financial Flows (Art. 7), Mutual Administrative Assistance in general

Continue reading