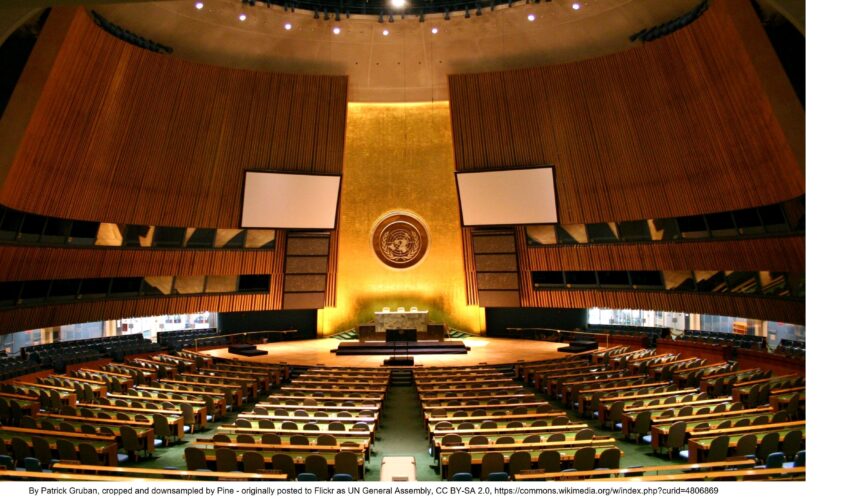

By Peter Hongler Early next week, the United Nations will host a series of multi-stakeholder consultations as part of its

Continue reading

Global Tax Symposium 2022 – programme and registration

Register here for the Global Tax Symposium, hosted virtually by NIPFP on 1st and 2nd of December!

Continue reading