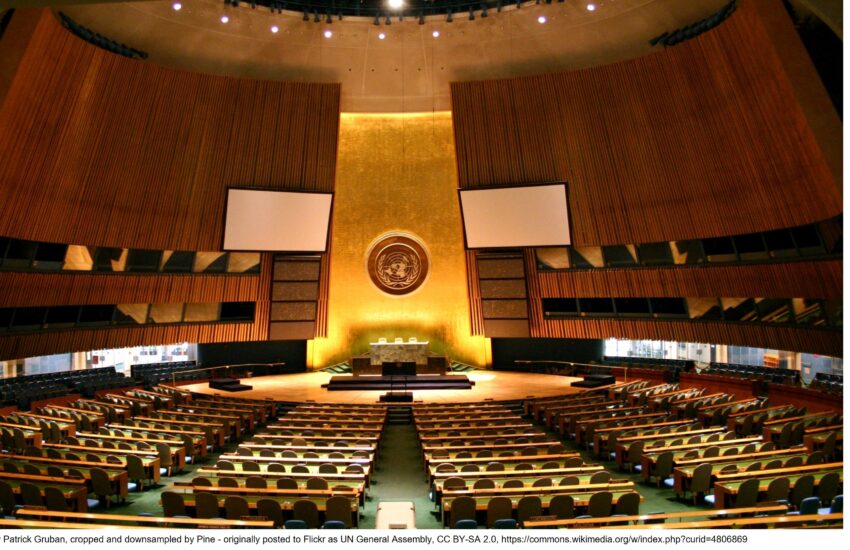

By Peter Hongler Early next week, the United Nations will host a series of multi-stakeholder consultations as part of its efforts to develop a UN Framework Convention on International Tax Cooperation. This initiative has been structured around three distinct workstreams: While all

Continue reading