Introduction: Why These Negotiations Matter

For decades, international tax cooperation has been shaped by a small circle of advanced economies, primarily within the OECD and the G20. While these forums have produced important outcomes—such as the Inclusive Framework on BEPS and the two-pillar solution—they have been criticized for their limited inclusivity and perceived legitimacy gap. Against this backdrop, the First and Second Substantive Sessions on a Framework Convention on International Tax Cooperation, held over the past two weeks in New York, mark a potentially historic shift.

The process is far from complete. But the fact that negotiations have begun under a UN umbrella is, in itself, a breakthrough. At the same time, the road ahead is long and filled with uncertainty. There are unresolved questions about the purpose, structure, and scope of this new framework. Unless these issues are confronted directly, the process risks producing a technically sound negotiating platform with little substantive clarity.

A Promising Start: Inclusivity and Transparency

The greatest achievement of the first two weeks of negotiations is the establishment of an inclusive and transparent negotiating forum. This may sound procedural, but it is a genuine milestone.

- Equal participation: Unlike in the OECD-led process, every UN Member State had a seat at the table. For developing countries—often rule-takers in global tax matters—this offers a long-awaited chance to shape the rules that directly affect their fiscal sovereignty.

- Transparency: Proceedings and outcomes were conducted with a degree of (public) openness rarely seen in international tax diplomacy. This builds trust, particularly among countries that have historically felt excluded.

The last two weeks have raised expectations that the UN framework could become the primary forum for international tax cooperation in the decades ahead.

A Long Journey Ahead

Despite this promising start, no one should mistake the New York meetings for a decisive breakthrough in substantive terms. The negotiations are at a very early stage, and history tells us that forging consensus on global tax matters is notoriously difficult. Perhaps the most important critique emerging from the New York negotiations is that too little attention has been paid to the framework itself.

A fundamental question remains unanswered: For what purpose are we creating this framework?

- Should it subsume the work of the Inclusive Framework?

- Should it take over from the Global Forum?

- Or should it carve out an entirely new agenda?

Policymakers must push for an explicit debate on the mandate and scope—not later, but now. Across all sessions, it became clear that many representatives still felt uncertain about the goals and functioning of the framework.

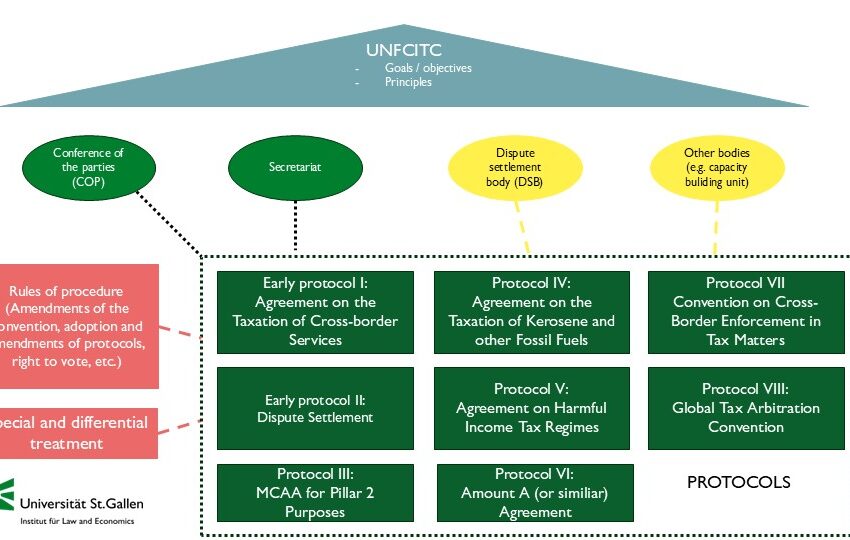

Institutional Blind Spots: COP, Secretariat and the Role of Protocols

The lack of substantive discussion was most visible when it came to the core institutions of the future framework.

- Conference of the Parties (COP):

Despite being the central decision-making body in most UN conventions, there was virtually no debate in New York about what powers the COP should have. Will it simply approve technical recommendations? Or will it be empowered to make binding decisions on global tax standards? - Secretariat:

Equally unclear is the role of the Secretariat. Will it be a purely administrative body, tasked with record-keeping and logistics? Or will it be entrusted with analytical functions, technical assistance, and monitoring of compliance? - Protocols:

Still many questions on how the protocols will interact with the framework remained unanswered. For instance, will there be a dispute settlement body in the Framework Convention to solve inter-state disputes within the protocols?

These questions are not minor details. They will determine whether the Framework Convention evolves into a living institution capable of driving policy, or remains a symbolic forum with limited practical impact.

Given the limited time under the current negotiation mandate, policymakers must insist that these issues be placed at the center of the next negotiation rounds in Nairobi in November. Policymakers should clarify the mandate of the framework convention, define the role of the COP and the secretariat and outline options on how the framework convention could interact with the protocols.

Conclusion

The first and second substantive sessions are a historic opening in the evolution of global tax governance. The United Nations has created a negotiating platform that is inclusive, transparent, and universal. This alone represents a paradigm shift, particularly for countries long excluded from shaping international tax rules. But this optimism must be tempered by realism. The substantive foundations of the framework remain undefined. Without clarity on scope, institutions, and mandate, the process risks stalling—or producing a framework that looks impressive on paper but lacks the capacity to deliver meaningful outcomes.

The coming months will be decisive. Policymakers should press negotiators to focus squarely on the core institutional questions:

- What is the mandate of the Framework Convention?

- What powers will the COP hold?

- What role will the Secretariat play?

Time is short, and expectations are high. To preserve the credibility of this process, these questions must be addressed before momentum fades. If the negotiations succeed, the UN Framework Convention could become a cornerstone of global governance in taxation. If they fail, the opportunity for a truly global tax forum may be lost for another generation.

(this blog was written with the help of a large language model)