1. Outline of the problem

The problem to be discussed in this blog post is the following:

The application of the Income Inclusion Rule (hereinafter “IIR”) as part of the Pillar 2 agreement will lead to the taxation of income that has a very limited link to the taxing jurisdiction (i.e., to the state of the ultimate parent entity [in hereinafter “UPE” or “UPE State”]). The question to be addressed is whether such link is sufficient from an international law perspective to justify taxation.

We will, therefore, review whether the UPE State actually has the jurisdiction to tax the income of the low-taxed operations abroad. If this is not case, levying the IIR will infringe international law obligations.

2. The genuine link doctrine

2.1 Overview

Maybe it is good for once to start the debate in a negative form. If we agree that the jurisdiction to tax has a legal content, we all would agree that it means that there should be no taxation in a certain state if there is no link to a jurisdiction. Otherwise, it is difficult to define any legal content if jurisdiction to tax would not be prohibited in such extreme cases. Moreover, each link justifies jurisdiction only to a certain extent. Therefore, there are links justifying limited jurisdiction and other links justifying comprehensive jurisdiction. Moreover, whether a link justifies jurisdiction depends on each field. Ownership could for instance be a sufficient link in sanctions law but not in antitrust law.

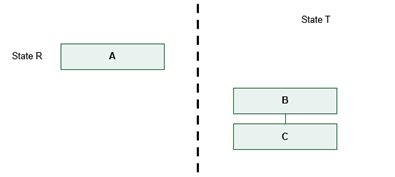

Examples help to better understand the legal question at hand. Let us assume the following case:

Company A is resident in State R and has no activities abroad. Company C is fully owned by company B, both are a non-related parties of Company A and are resident in State T. It seems to reflect the current understanding in international tax law that State T would infringe international law if the income of Company A would be taxed in State T., i.e., there must be at least a link to the territory of State T, be it source or residency.

2.2 The question of ownership

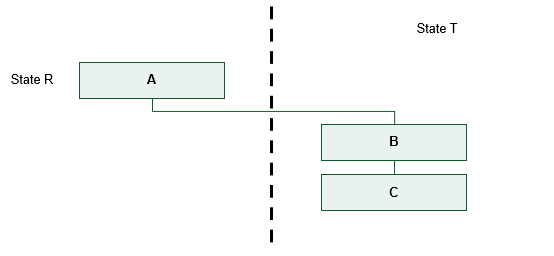

However, it gets trickier if there is a very limited link to a jurisdiction. Let us assume that Company A (same example as above) owns 100% of the participation in Company B resident in State T.

Again, State T would tax the entire income of Company A. Is such link now sufficient to tax the entire income of Company A? Again, the standard argument would be no, as State T is only the source state and source states do not have the right to the tax the worldwide income in such a situation.

However, State R seems to be able to tax the entire income of C in case such State applies an IIR and B and C (through a jurisdictional blending) are taxed below 15%. One could, therefore, argue that “ownership” per se but not “being owned”, directly or indirectly, is a sufficient link to tax the income of the owned (but not the owning) company. However, it is more challenging to demonstrate why ownership is really a sufficient link, for instance, to tax foreign-to-foreign transactions.

If we include some more elements into our example, this issue obvious. Let us assume Company A is a holding company with participations worldwide. It is owned by two shareholders (X, Y, each 10%) in State R and State T. The other 80% are held by portfolio investors worldwide. Again, the application of the IIR will lead to taxation of the income of B and C (based on a jurisdictional blending) in State R.

The application of the IIR in State R, however, leads to an arbitrary result as (direct or indirect) ownership might be considered a very limited link in particular if the owner of the parent company (i.e. the UPE in case of Pillar 2) is again owned by foreigners as this is the case with many listed companies and as this is the case in the present example since 90% of the share capital of Company A is owned by persons resident abroad.

MNE groups subject to the GloBE can be owned by domestic or foreign shareholders, however, if the allocation to the UPE only depends on the residency of the UPE and not of the residency of its shareholders, the link to the UPE State might be very limited and by very limited we mean that the top holding company is resident in the UPE State and this seems to be a sufficient link (residency, of course, is traditionally triggered by the seat or the place of effective management [hereinafter POEM] in that state). This is true, although, the effective management (in the sense of the POEM) of a holding company is a very limited task and does not require a lot of substance in the UPE State, so does having the seat in a jurisdiction. Therefore, the only link between the activities in state T and the UPE State is that a company is indirectly owned by the UPE and that the UPE has (limited) presence in the UPE State.

Moreover, ownership for such purpose means having an equity interest. Therefore, it does not even mean that the activities of low-taxed subsidiaries are mainly financed by the UPE as debt financing is ignored in the application of the IIR. For instance, let us assume that 80% of the assets of company A are financed by a third-party debt granted by a bank in a third state and also 80% of the assets of Company B are financed by debt and the lender is a bank resident in a third state (80%).

In this situation, the link to State R becomes even more limited as only 4% (100*20%*20%) of the value of C is financed through equity contributions (or retained earnings) out of State R. It will become even a neglectable economic ownership, if look at the ultimate beneficial owners in the structure. In this case only 0.4% (10%*4%) of the value of Company C is owned by residents of State R, however, State R is allowed to tax the entire income of C up to 15% if such income is not taxed in State T or taxed at a low rate. This is an extreme outcome and if we compare it to the starting example, the outcome is really surprising as economic ownership of 0.4% by ultimate beneficial owners in one state might justify comprehensive jurisdiction in corporate tax matters compared to no taxation in case of 0% ownership.

2.3 Additional elements

Of course, there might be some reasons why ownership combined with other elements justifies jurisdiction over the foreign company. In other fields of international law, there has been a more detailed discussion of what is considered to be a sufficient link. As an example, in antitrust law there is an intense debate about the so-called effects doctrine, i.e., if there is an effect on local markets, jurisdiction in anti-trust matters might be justified notwithstanding the fact that the foreign enterprise has no physical presence in the market state. For instance, in case of an antitrust merger control, it is justified to apply EU antitrust law if it is “foreseeable that a proposed concentration will have an immediate and substantial effect in the European Union” (Judgement of the General Court of the EU, 12 June 2014, Intel, T-286/09, Para. 233). In a similar way the US Supreme Court has held in simplified terms that in antitrust matters foreign-to-foreign transactions should be out of scope of US antitrust law as this would otherwise be seen as an interference in the other jurisdictions approach towards regulating markets. Or as it was held in the F. Hoffman-LaRoche, Ltd. v. Empagran S.A. case by the US Supreme Court:

“Why should American law supplant, for example, Canada’s or Great Britain’s or Japan’s own determination about how best to protect Canadian or British or Japanese customers from anticompetitive conduct engaged in significant part by Canadian or British or Japanese or other foreign companies?” (US Supreme Court, F. Hoffman-La Roche Ltd. v. Empagran S. A., 542 U.S. 155 (2004).

Of course, these short remarks are not sufficient to discuss the topic in a comprehensive form. However, it seems that similar arguments could be made for tax purposes. I.e., the following crucial question has to be answered: Why should states have the right to interfere into the tax systems of other states if these other states tax corporate income at a rate below 15%? This is indeed the main concern from an international law perspective as states are not anymore able to determine whether and to what extent activities in a state shall be subject to corporate income tax in case the IIR and/or the UTPR applies.

Of course, in abusive circumstances e.g., if a company is only interposed as a letter box than there is a sufficient link to the country of the shareholder of such interposed company if value creation happens actually in the parent state. It was already demonstrated at another instance that traditional CFC rules are already a rather extreme example of the wide scope of the genuine link doctrine and could be sign of what is not anymore compliant with international law (Peter Hongler, Justice in International Tax Law, p. 85 et seq. open access: https://www.alexandria.unisg.ch/257972/), in particular if they not only apply in abuse circumstances in which there is no substance in the state of subsidiary. In a positive form, there is a sufficient link to the state of the parent company in abusive circumstances and such link might be the source principle (i.e., the income was generated in the source state) or the benefit principle (i.e., the income was generated by using benefits in the parent state). Insofar, there is indeed a similarity to antitrust law as the source or the benefit principle might be the “link” compared to the territorial effects in case of antitrust law. Therefore, applying the IIR in abusive situations only, seems to be in line with international law due to an actual link to the UPE State, if it is at least proven that the income was partly generated in the UPE State or at least if benefits of the UPE State were used for generating the income.

This shows that value-based judgements (i.e., reference to the source or the benefit principle) also influence the legal analysis. This is also why Pillar 1 is prima facie in line with the genuine link doctrine as there is a normative justification for taxation in the market state (i.e., the source or the benefit principle as justification to tax principles). However, it is extremely difficult to justify the allocation of the tax revenue to the UPE State under Pillar 2.

To conclude, by applying the IIR in the UPE State, the current proposal stretches the boundaries of the international law framework too much and the proposals are according to my understanding infringing international law. This is a serious concern but the current narrative according to which multinational enterprises do not pay their fair share seems even to justify policies which infringe international law obligations.

A last resort to avoid an infringement of international law obligations by Pillar 2 would be to argue that global interests justify the jurisdiction of the UPE State (see for such approach Cedric Ryngaert, Jurisdiction in International Law, 2nd ed., OUP 2015, e.g., this could be the case if a global minimum carbon tax is introduced). However, such position again requires that the proposed legislation is indeed in the global interest. As the first public reactions, not only from developing countries, have shown, the proposed allocation (IIR priority) of the additional revenue due to Pillar 2, however, is not following a global approach but is driven by the interests of some of the strongest economies in the world. Of course, this is not the place to discuss this in detail but it is highly disputed whether (and which) developing states will indeed benefit from the Pillar 2 agreement. Therefore, prima facie, jurisdiction is not be justified by referring to global interests.

3. Does an explicit agreement among states solve the issue?

Of course, we could argue that an international agreement through a multilateral convention implementing Pillar 2 would solve the issue because, at least from a legal perspective, states agree that the UPE State shall be allowed to tax the income of local (direct and indirect) subsidiaries if the requirement of the application of the IIR are fulfilled. Therefore, there is an international treaty overriding the genuine link doctrine. This is, however, a very challenging question from an international law perspective and we cannot fully solve it within the present post. The following is of importance:

- First of all, there is a dispute of whether the genuine link doctrine is derived from customary international law, treaty law or whether it is a legal precondition of the international law regime. Depending on the result the collision between the multilateral treaty needs to be solved differently under the collision rules of international law. Potentially there is a conflict between customary international law and treaty law, between treaty law and treaty law or between a legal precondition of the international law regime and treaty law.

- Second, the question is what the validity of the new multilateral treaty is if it is enforced through coercive measures (i.e., the threat of the application of the IIR and/or UTPR). In other words, it is problematic that the agreement on Pillar 2 has not been a genuine agreement, but an agreement achieved through coercive measure, and this might also influence the legal analysis of whether the application of the IIR in an individual case is infringing international law.

And, of course, for countries not agreeing to the multilateral convention, such arguments do not even apply.

4. Conclusion

To conclude, the genuine link doctrine is not only a legal principle in the sense that extraterritorial legislation is prohibited from an international law perspective but it has also an important normative content in the sense that a constant undermining of the genuine link doctrine does not lead to more justice in the field of international taxation. Therefore, from this perspective Pillar 2 should not be implemented in the current form. Amending the current design (e.g., changing the rule priority, including more carve-outs, using the additional funds for global problems, e.g. to fight climate change) would potentially resolve the issue discussed. However, for the moment the Pillar 2 proposal in general and the application of the IIR in particular infringe international law obligations.

Literature

- Gadzo Stjepan, Nexus Requirements for Taxation of Non-Residents’ Business Income, IBFD 2018

- Baker Philip, Some Thoughts on Jurisdiction and Nexus, in: Guglielmo Maisto (ed.), Current Tax Treaty Issues, EC and International Tax Law Series, IBFD 2020, p. 441 et seq.

- Hongler Peter, Justice in International Tax Law, IBFD 2019 (open access: https://www.alexandria.unisg.ch/257972/ ), 74 et seq.

- Hongler Peter, International Law of Taxation, OUP 2021, p. 3 et

Terrific analysis!! Congratulations!!