Last Saturday, the G7 announced political support for the adoption of global minimum taxes levied on multinational enterprises’ (MNEs) headquarters. This announcement has not been received without controversy, especially concerning the potential impact of such minimum taxes on developing countries. While some see in them just as another measure favouring rich countries, others emphasize the “fiscal space” such taxes would afford to developing countries (see for example the discussions in a GLOBTAXGOV roundtable organized on 2 June).

This controversy and the fact that most design features of a global minimum tax have not yet been agreed on make it worthwhile to revisit whether the adoption of a “comprehensive” minimum tax such as recently proposed by the United States (i.e. without substance carve-outs and without worldwide blending) would be in favour of developing countries which mainly import capital and host few headquarters of MNEs.

In this post, I observe that the essence of the controversy is a conflict between two different hypotheses about the role of the tax burden in investors’ decision-making processes. Both are theoretically plausible, which is why empirical assessments may help to make the difference. However, I also observe that previous empirical studies do not provide conclusive answers. Finally, I provide some ideas for future directions of study.

Would MNE subsidiaries in developing countries be affected by a comprehensive minimum tax?

Most developing countries have rather high statutory tax rates, but often offer tax incentives which may reduce the effective tax rates for MNEs. In addition, the ability of MNEs to shift profits to low tax jurisdiction may further reduce the effective tax rate on the“true” profits generated on developing countries (i.e. before being shifted elsewhere).

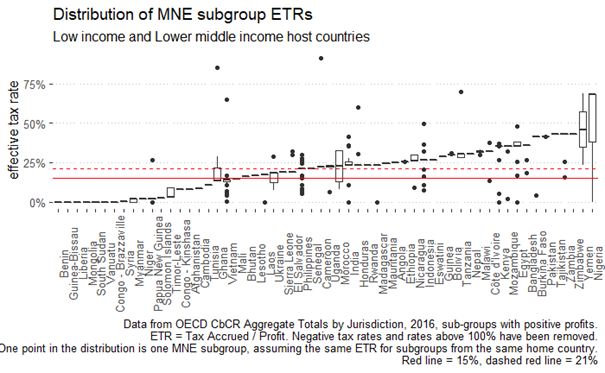

The figure below presents evidence from aggregate country by country reporting data, published by the OECD. In many low- and lower-income jurisdictions in the database, MNEs from most home countries report effective tax rates (ETRs) higher than 15%, e.g., in Tanzania, Mozambique, Pakistan, Nigeria, Indonesia, Egypt, Kenya. However, for example in Congo-Kinshasa, Congo-Brazzaville, Tunisia, Cambodia, Niger, MNEs reported effective rates lower than 15%. This data should be taken with a grain of salt, since for some countries only few data points are available, and there are some other known limitations. Yet, it is likely that a significant number of MNEs earning profits in developing countries may face a higher effective tax rate if home countries implement global minimum taxes (although by no means all of them). A global minimum tax would also reduce MNEs’ incentives to engage in profit shifting, which may further increase the “true” effective tax rate on investment in developing countries.

For the code used to make this graph, see my GitHub repository.

For the code used to make this graph, see my GitHub repository.

Two different stories about investors’ decision-making processes

The developing country case against a comprehensive minimum tax relies on the assumption that a lower tax burden on foreign investors may compensate for disadvantageous conditions for investment in developing countries compared to more developed countries (such as macroeconomic instability, lack of infrastructure, unfavourable geography, etc.). If this view is accurate, the elimination of the benefits of low-tax regimes in developing countries through a global minimum tax may deprive developing countries of one way to compete with developed countries for capital. Of course, this also presupposes that developing countries are in fact able to impose lower rates than developed countries. While there is downward trend in tax rates among developed countries, most do currently impose positive effective tax rates and have on average fewer exceptions, among others because voters prevent a complete race-to-the-bottom. This means that developing countries have some margin to levy lower rates than most developed countries.

Arguing in favour of minimum taxation from a developing country perspective, on the other hand, requires to imagine an investor’s decision-making process as consisting in two steps: One needs to assume that the level of tax imposed by host countries does not significantly affect the decision of the investor to invest in any developing country due to fundamentally different conditions found in developing countries. These conditions can be negative (such as those mentioned above) but also positive (such as for example lower wages or growing consumer markets). The level of tax imposed by the host country might only be decisive for the decision in which among different developing countries with similar conditions to invest. For one of the earlier enunciations of this theory, see Reuven Avi-Yonah’s 2000 article (pages 1647-48). By competing through the tax system, similar developing countries then mainly prevent each other from levying tax revenue without increasing aggregate investment into them considered as a group. Consequently, the absence of minimum taxation imposed by the headquarter country mainly benefits the investors, and hence developed country residents. A global minimum tax would then eliminate the incentives for developing countries to compete among themselves, and thereby lead in the aggregate to higher tax revenues in developing countries while the total level of investment into developing countries remains unaffected. Some redistribution might occur, e.g. from those countries currently offering tax incentives to those that do not, but this would not speak against a minimum tax from a developing country perspective. Moreover, to reap higher tax revenues, developing countries would need to take legislative action and eliminate tax regimes that impose a lower effective rate than the global minimum tax rate imposed by the home country or impose a “conditional minimum tax” on their own such as proposed by Noam Noked.

Lack of empirical evidence

The OECD’s impact assessment discusses the question of investor reactions to a pillar 2 by reviewing previous literature, but does not provide conclusive evidence (pages 169-172). In general, much of the literature on the impact of (statutory or effective) tax rates on investment is concerned with the question whether taxation plays a role at all in the investment decision (on average, it does), but does not attempt to distinguish between both hypotheses noted above.

One obvious limitation for empirical assessments is that comprehensive global minimum taxes have not been tried before. Nevertheless, a global minimum tax can be understood as being situated on a continuum of different types of tax treatments of the profits that investors earn abroad. A worldwide system with strong CFC rules, for example, is closer to a system with a global minimum tax than a system with participation exemption and/or tax sparing credits. A 2013 IMF Working Paper found that after the UK switched from a worldwide to a territorial system, UK outward investment became more sensitive to the host-country’s statutory corporate income tax rate. Yet, the analysis suffers from the lack of availability of effective tax rate data and does not assess whether low-tax developing countries attract investment at the expense of high-tax developing countries or rather at the expense of high-tax developed countries. Nevertheless, comparing investor behaviour from worldwide vs. territorial countries may nevertheless be a useful avenue for more fine-grained impact assessments.

What to do now?

I hope that more targeted research will emerge, and I also hope to be able to contribute to that myself. At the moment, however, it is fair to say that a much uncertainty regarding the effect of global minimum taxes on developing countries remains – and this may not be resolved in the near future. Of course, it may be worthwhile to experiment and assess the impact after a few years. However, the affected parties should have a say in whether such an experiment should be conducted. It should be noted that there are no evident legal constraints for any country to introduce a global minimum tax in domestic law. Since only the MNE’s headquarter company would effectively be liable to the tax, it does not infringe other countries’ sovereignty. However, endorsing global minimum taxes as “global standards” is something different and should only be decided in more inclusive fora than the G7 or even the G20.