In May 2020, the European Commission presented in Parliament € 750 billion stimulus plan. Part of this plan is to fund recovery through own resources such as a levy on companies that draw huge benefits from the EU single market as well as a digital services tax. It is estimated that these would bring in revenue from to the tune of € 11.3 billion per year. Beyond the EU many more countries such as India, Indonesia, Philippines and Australia have applied or expressed their desire to apply such tax. However, worried that this will apply to technology giants that are residents of the United States, the United States Trade Representative has responded with a threat to investigate these measures in ten countries– Austria, Brazil, the Czech Republic, the European Union, India, Indonesia, Italy, Spain, Turkey, and the United Kingdom. Investigations initiated under US’ Section 301 of the Trade Act of 1974 seek to determine if the digital services tax amounts to discrimination against U.S. companies; retroactivity; and possibly unreasonable tax policy. In response the US has also suggested that it will consider trade sanctions such as tariffs. This is the culmination of series of events resulting in current impasse in digital tax agenda. It also reflects deeply on the confidence, or lack thereof, in the multilateral process exacerbated by the severity of current fiscal strain.

BEPS agenda

Much has changed since the G20 embarked on the global process of patching international tax laws in 2013 under the aegis of the OECD. The fundamental reform of a system exposed to widespread avoidance was considered necessary since tax revenues were lost to economies that chose to offer preferential tax regimes or through glaring deficiencies in tax laws. It has been argued widely that tax laws have not kept pace with the changing reality of digitalisation. While work progressed over the years, the Action point 1 within the Base Erosion and Profit Shifting (BEPS) became a thorny issue. No clear proposition emerged until 2018 on best practices to better tax technology companies. With the freedom to operate in a jurisdiction without any physical presence, many structured corporations chose to locate their operations in jurisdictions that slimmed their effective tax rates. While there was no concrete proposal, in its 2015 report on action point 1, the OECD it suggested that an equalisation levy, withholding tax or test for significant economic presence were possible ways to tackle tax challenges arising from digitalisation. Taking cue from the report India was the first country in the world to introduce a 6 per cent levy on payments made by a resident in India to a non-resident for sale of advertising space. This tax was made applicable through a unique form of legislation. The tax was implemented through the Finance Act 2016, as opposed to an amendment to the Income Tax Act 1961 that would be subject to treaty obligations thus limiting the application of the tax. This kicked up a storm: Experts suggested that these measures would result in double taxation. Yet, such levies were subsequently implemented in France, UK, Hungary and Italy. The OECD recognised swiftly that countries were leaning towards a unilateral tax since the consensus seeking Inclusive Framework, consisting of 137 countries, had reached a deadlock. To renew confidence in the consensus framework, OECD paced up its response and in a departure from its previous commitments proposed that the issue of taxing rights, not originally on the BEPS action plan, would be examined without prejudice. This was a marked departure since the last time the basis of international taxation were visited was the early 1920s. Economic and political circumstances had been very different when the prevalent laws were conceived. Developing economies such as India were not politically autonomous. Thus the pillar 1 and 2 were proposed.

Pillar 1 proposal

In 2019, two pillars of the international tax sought to be installed, of which one would redistribute tax among countries based on new taxing rights. Pillar 1 is a rather complex series of rules, that requires proper estimation of routine profits and allocation of residual profits to countries on the basis of revenue reported in a jurisdiction. History has borne out the problem with pinning down returns in excess of those considered normal. The excess profits tax, implemented by several countries including US and UK during World War I and II, was riddled with complications of exclusions, rebates and more importantly the notion of excess returns in post-war years. While the tax did reap significant revenue its administration was a challenge and it continued only until normalcy returned followed by codification of tax laws. Thus, Pillar 1 was not met with enthusiasm. Yet the OECD set itself an ambitious deadline for 2020.

Fiscal pressure from Covid-19

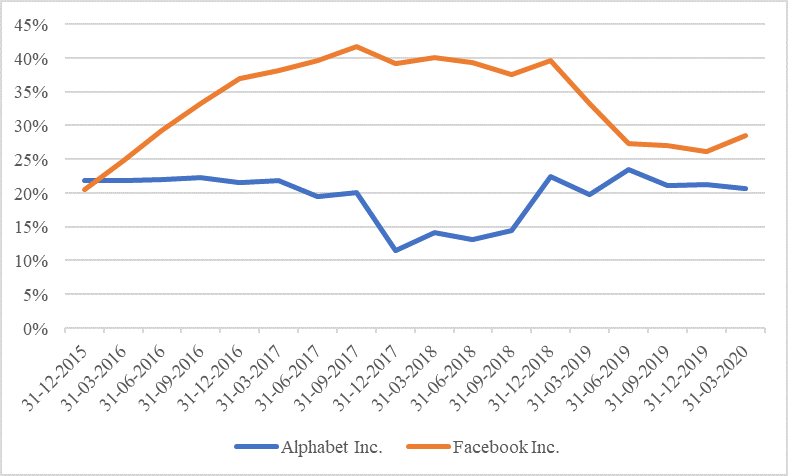

Under such constrained circumstances, COVID-19 was another setback to the multilateral process. Countries are grappling with domestic fiscal challenges and may find it hard to commit to the process. With the onset of economic recession countries announced recovery packages, that until May 2020 range from 2.5 % of GDP in China to 20 per cent in Japan. The EU is mulling the use of escape clause to allow budgetary support while US has extended support of 11 per cent. With mounting debt, and shortage in tax revenues expected from depressed economic activity, the only foreseeable option is expanding the tax base. Technology companies have remained resilient through the current crisis. It is seen in Figure 1, during the pandemic Facebook reported quarterly net profit margins similar to those prior to the pandemic. In 2019, Federal Trade Commission investigations for breach of privacy lowered the profits of Facebook, that are now on a rebound. In the case of Alphabet Inc. the profit margins in fact reversed to earlier levels in December 2018 after decline during the quarters of 2018, resulting from EU anti-trust fines that exceeded the provision for taxes, was reversed.

Quarterly Net profit margin (%)

Source: stock-analysis-on.net/NASDAQ/Company/Facebook-Inc/Ratios/Profitability/Quarterly-Data#Ratios-Summary

Spain and Italy have reported among the largest number of infections and have high debt to GDP ratios within the EU.

Under such circumstances countries have chosen to move ahead independently. In fact Spain has declared that it will go ahead with the tax if no consensus is reached. This is much in line with the Franco-German joint declaration in 2018 that stated “DST will enter into force on 1st January 2021, if no international solution has been agreed upon. The directive would not prevent Member States from introducing in their domestic legislation a digital tax on a broader base” . Interestingly, in India, various tax proposals were presented as the Finance Bill before the lower house in February and then when passed are enacted as the Finance Act 2020. In March the Finance Bill did not contain any mention of a levy, whereas the Act introduced a levy of 2 per cent on an e-commerce operator from e-commerce supply or services made or provided or facilitated by it, provided or facilitated by it “(i) to a person resident in India; or (ii) to a non-resident in the specified circumstances as referred to in sub-section (3); or (iii) to a person who buys such goods or services or both using internet protocol address located in India.”. Thus further reflecting on the direction of discussions.

Future of the multilateral process

The implementation of unilateral taxes has brought the consensus based system to a precipice. The United States may not potentially carry forth in the negotiations and to add to that the application of such aforementioned tax would attract a counteracting tariff on imports from UK, France, Italy and Spain. This raises very important questions for the state of multilateralism. While digital taxes are unilateral measures, the investigations and tariff themselves mark a departure from the well-established WTO process.

At the core of the discussion is a more fundamental economic problem. It is clear that tax policy can have a significant impact on international economic relations. However, it is also important for countries to acknowledge that economic interests are not aligned for consensus. In my earlier work, I have shown that while India accounts for 12.5 per cent of digital buyers, only 1 per cent of global revenues from various digital platforms are earned by it. US on the other hand for a similar share in digital buyers reports a third of the global revenues from these services. As for China it has comparable share of revenue and users. The underlying reasons for this may be China’s hard localisation policy that makes its domestic companies among the largest in the tech sector whereas residence of tech giants is in US. Further, even though it is agreed among experts that digitalisation is economy-wide, Pascal Saint-Amans, noted that there is an “emerging view” that “reallocation of taxing rights” through Amount A in Pillar 1 be limited to the digital companies, whereas China and USA have opposed such ring fencing.

Thus it is expected then that reallocation of taxing rights will be met with some resistance. To add to that, prior to the G20 meeting in Riyadh the US treasury secretary proposed that pillar 1 proposals be applied on a safe harbour basis, a position that US continues to support. Signalling exclusions early in the process of negotiation can rupture confidence. Further, pillar 1 is not a simple solution to administer. Apart from separating routine from non-routine profit, complexities around how the taxes so assessed under Pillar 1 will be redistributed and who will carry out such functions may further encourage countries to adopt unilateral taxes. An often cited limitation of such taxes is that revenue collected from such levy is insubstantial, as has been demonstrated in the case of India. However this is not the only end it achieves. A possible restructuring of transactions can be a means to the end of inhibiting tax avoidance. While the last word on the digital tax agenda has not been spoken, US’ calibrated attempt to withdraw has laid bare the divergent demands from the consensus based framework. It may perhaps be more pragmatic to convert such levies into withholdings taxes through bilateral negotiations.